How do I open a new account via online banking?

To open an additional deposit account online, please select ‘New Application’. The account application will then start in a new window. You will be able to select from the Fixed Term Bonds or Notice Accounts available.

Your information will be pre-filled based on the details we hold for you. If your details require updating, please close the application window to take you back to online banking where you can make the necessary changes before proceeding with the new application.

For charity customers, if you are registered online, you can send us a secure message detailing the new account you wish to open, and we will process it for you. You can also call us on 020 7190 5599 or freephone 0800 083 2228 between 9am and 5pm Monday to Friday.

How do I access secure messaging?

Should you wish to send us a message, log in to online banking and select ’Contact Centre’. This allows the contact between you and United Trust Bank. Please note, should you wish to send additional funds for your maturing bond, we require a ‘Top Up’ message to inform us that funds are on the way.

How do I change my personal details?

You can change your address and contact details via online banking. Once you have logged in, please select ‘My Details’ then ‘Contact Details’. Select the relevant option(s) to change your details accordingly. You will receive a Two Factor Authentication notification to approve the change.

To change your email address, please send us a secure message or call us on 020 7190 5599 or freephone 0800 083 2228 between 9am and 5pm Monday to Friday.

How do I change my mobile security setting?

To update your Two Factor Authentication (2FA) preferences, select ‘My Details’ and ‘Mobile Security’.

If you currently have SMS notifications and wish to opt for Push Notifications, you will need to download the SecurEnvoy Authenticator app from a relevant app store and proceed with Push Notification enrolment. An email will be sent to your registered email address with a one-time code to input on screen. To complete registration, scan the QR code when prompted using the SecurEnvoy Authenticator app.

If you currently have Push notifications and wish to opt for SMS Notifications, you will receive a one-time code and you can then proceed to enrol for SMS notifications.

How do I view, add or cancel the details to use for my nominated bank account?

To view, add or cancel a nominated bank account, log in and select the ‘Nominated Account’ option at the top of the page.

For business and charity customers, please note this service is not yet available, so please email us with the request, including a copy of a recent bank statement (dated within the last three months). Please also ensure the request is made in accordance with the signing arrangements on your account.

For personal customers, should you wish to add a new nominated bank account, select ‘New’ and provide the new bank details:

When you have added the new nominated bank, you will see it listed on your online banking with a status of ‘pending’. This is because we need to verify the information first. When we have done that, the status will change to ‘active’.

To use your new nominated bank account, you first need to unlink your old one from the accounts you hold. To do this, head back to the accounts page, select the account in question and then choose ‘My Linked Account’ at the top. Remove the link, and then you can add a link to your new nominated bank. We recommend you then cancel the old nominated bank.

How do I give you my maturity instructions via online banking?

You can watch our how-to video guides on setting your instructions by heading to our maturity page here.

14 days prior to your maturity date, we will send an SMS notification to your registered mobile phone to advise you that you are able to provide maturity instructions online.

When you log in to your online banking and see your account summary, you will be able to see which account is approaching maturity.

When you click on the account in question, you then need to select the ‘Maturity Instructions’ tab at the top:

You then need to click on the yellow ‘Add maturity instruction’ box at the bottom:

Reinvesting the full balance

If you want to reinvest the full balance, including the interest, please choose ‘Reinvest’ or ‘New Account’ and then choose the desired product. Tick the box to confirm you have downloaded the key features and then answer ‘Yes’ to using the remaining balance:

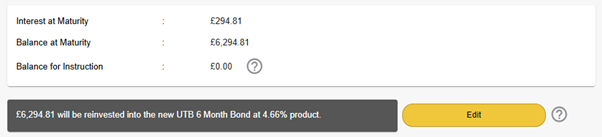

Your confirmation page will then reflect your choice:

Simply press ‘Complete maturity instructions’ underneath and enter the one-time passcode when prompted, sent either by SMS or to your SecurEnvoy app on your phone.

Partial reinvestment

If you wish to reinvest some of your balance and have the rest returned to your nominated bank, when you are asked the question of ‘Use the remaining balance?’ simply select ‘No’ and enter how much of the balance you wish to use.

On the confirmation page you will see that you still have a remaining balance awaiting instruction:

Simply press ‘Add maturity instruction’ and follow the ‘Repayment’ steps, selecting ‘Yes’ for the remaining balance:

Your confirmation page will then be updated accordingly:

Simply press ‘Complete maturity instructions’ underneath and enter the one-time passcode when prompted, sent either by SMS or to your SecurEnvoy app on your phone.

Full repayment to nominated bank

If you wish to have the full balance, including any interest, returned to your nominated bank at maturity, first select the option of ‘Repayment’, and then answer ‘Yes’ to using the remaining balance:

Your confirmation page will then reflect your choice:

Simply press ‘Complete maturity instructions’ underneath and enter the one-time passcode when prompted, sent either by SMS or to your SecurEnvoy app on your phone.

How do I change my interest preferences?

In online banking, select the account you wish to update and then select ‘My Linked Account’. Here you have the option to compound interest or to have it paid to your nominated bank account. Please note, you are only able to have interest paid back automatically if you have a Notice Account or a Fixed Term Bond over one year.

You will need to ensure you have selected a linked account to make any payments to your nominated bank.

For business and charity customers registered online, simply send us a secure message with the request. Please note, this must be in accordance with your account mandate, i.e. if changes require two signatories, we will need both to confirm before we update your preferences.

How do I request a withdrawal/place notice on my accounts(s)?

To submit a withdrawal request or place notice, please log into online banking and select ‘Messages’ to send us a secure message and make the request.

For United Trust Bank notice accounts, you will be able to place notice on your account. The notice period that applies to your account was specified at account opening. A payment to your nominated bank account will occur at the end of the notice period.

For Call Accounts, you will be able to request a withdrawal to your Nominated Bank Account, in line with our Terms & Conditions.

How do I find the interest rate for my account(s)?

To check the interest rate on your account(s), log in to Online Banking and select ‘Accounts’ and then select the account you wish to see.