How do I make my account a joint account?

If you wish to add a second account holder to your account, and they are not an existing customer with United Trust Bank, we will require an application form to be completed. Please contact us to request this, and we will then confirm when the account has been updated.

You are only able to add a joint account holder if interest has not been applied to your account during the current tax year.

You are not permitted to add a joint account holder to an ISA as they are Individual Savings Accounts and can only be held individually.

How do I change the name of my account?

If you are changing your name, you will need to write to us. We will require an original or certified copy of a marriage certificate, deed poll (or statutory declaration) or decree absolute.

If you are reverting to your maiden name, we will require your decree absolute together with an original or certified copy of your marriage certificate, birth certificate or valid passport showing your maiden name.

Your document can be sent to United Trust Bank, One Ropemaker Street, London, EC2Y 9AW. We would recommend enclosing a covering letter along with your account number.

We will send you confirmation as soon as the change has been made.

I hold Power of Attorney for an existing customer. How do I update this with you?

If you hold Power of Attorney for an existing customer and would like to register that with us, please contact us here. You will also need to complete the Power of Attorney application form, which we can provide to you.

The Power of Attorney must be registered with the Office of the Public Guardian, and we will need to see either the original or a certified copy of the document. Alternatively, if you have a 13-digit access code (beginning with the letter V) then you can confirm that to us instead.

Can I add funds to my account?

Fixed Term Bonds can be topped up at maturity only. We need to receive the top-up deposit from your nominated bank account at least one day before maturity.

If you have opened an account that allows additional deposits, such as a Notice Account, you can make transfers as you please from your nominated bank account up to the maximum balance allowed.

I have requested a payment. When should I expect to receive it?

Payments are made by Faster Payment to your nominated bank account and will be received on the date your Fixed Term Bond matures, or on the expiration date of your notice period.

How do I withdraw money from my Fixed Term Bond?

Early withdrawals are not permitted on our Fixed Term Bonds, unless under exceptional circumstances. These may include if you are in financial hardship or suffering from a long term illness and having access to your savings would help your situation. Early withdrawals are granted entirely at United Trust Bank’s discretion and we may apply an early withdrawal charge for breaking your bond ahead of maturity.

If you are experiencing financial hardship, please find out how we can help here.

I have a Notice Account. How do I place notice to close or make a withdrawal?

Should you wish to withdraw funds from a notice account, you will need to consider the notice period on your account prior to submitting your request.

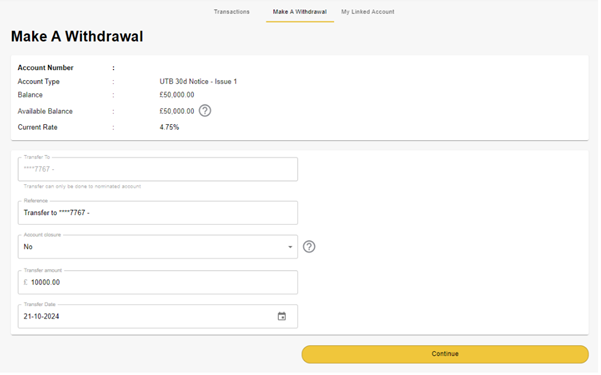

If you are an online banking user, simply login to your account, select the relevant account and then choose the option ‘Make a Withdrawal’. You then have the option to choose whether it is a partial withdrawal or a full closure. Please note, to keep the account open you must have a balance of at least £5,000 left after the withdrawal.

See below for an online banking withdrawal example:

If you are not an online user, please call us on 020 7190 5599 between 9am and 5pm Monday to Friday.

What rates do existing customers get?

We offer existing customer rates and terms to customers who have been with us for at least 3 months.

If you have online banking and have been with us for at least 3 months, please log in and select ‘New Application’ to open an additional account. You will then see the existing rates available to you.

Alternatively, please contact us to find out the preferential rates and terms on offer.

Can I change how the interest is paid on my account?

If you want to change how your interest is paid on an existing account, you can do this using online banking. Simply select the relevant account and then choose ‘My Linked Account’. You will then see the option to choose whether to have interest compounded or paid out annually.

Alternatively, you can contact us with your request.