United Trust Bank’s most recent broker sentiment survey has revealed that around 57% of brokers operating in the fields of bridging, development and asset finance expect lenders’ credit policies to stay largely unchanged over the next 12 months.

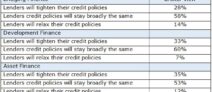

There were slight variations between brokers operating in the different sectors but, on the whole, 57% of brokers expected lenders to keep their credit policies broadly similar, 32% expect them to tighten and 11% thought that lenders would relax them.

What do you think will happen to lenders’ credit policies over the next 12 months?

| Bridging Finance | Broker View |

| Lenders will tighten their credit policies | 28% |

| Lenders credit policies will stay broadly the same | 58% |

| Lenders will relax their credit policies | 14% |

| Development Finance | |

| Lenders will tighten their credit policies | 33% |

| Lenders credit policies will stay broadly the same | 60% |

| Lenders will relax their credit policies | 7% |

| Asset Finance | |

| Lenders will tighten their credit policies | 35% |

| Lenders credit policies will stay broadly the same | 53% |

| Lenders will relax their credit policies | 12% |

Harley Kagan, Managing Director – United Trust Bank, commented:

“It’s good to see that most brokers believe lenders are already operating with an eye on the future. However, it’s perhaps unsurprising given the level of uncertainty surrounding Brexit, the UK economy and the residential property market, that many brokers feel some lenders will be tightening their purse strings over the next 12 months. Anecdotally we’ve heard from some brokers that lenders who were once happy to consider certain loans are now being far more cautious even with well-established customers. This ambiguity will frustrate brokers, but as long as they’re aware that experienced, ‘through the cycle’ lenders like UTB are still very keen to lend, they should be able to find quick and competitive funding solutions for their clients.

“From a broker perspective there are obvious advantages to dealing with a specialist lender which can quickly adapt to changing market conditions and be flexible in applying their credit policy to marginal cases. At UTB we consider every proposal on its merits and when required will use our knowledge and experience to formulate a solution which will hopefully give the borrower and the broker what they need whilst satisfying the Bank’s risk appetite.

“United Trust Bank is an approachable and dependable lender. We help house builders, property developers and SMEs who wish to seize opportunities in spite of uncertainty and support them through the ups and downs of the economy and the housing market.”